do you have to pay taxes when you sell a used car

Do I Pay Taxes When Selling My Car. Typically most states charge between 5 and 9 for their sales tax says Ronald Montoya senior consumer advice editor at Edmunds.

Understanding Taxes When Buying And Selling A Car Cargurus

Although a car is considered a capital.

. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply. You do not need to pay sales tax when you are selling the vehicle. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on.

Correct answer Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Even in the unlikely event that you sell your private car for more than you paid for it special. Used car dealerships will include this in the total cost of the vehicle.

In most cases you do not have to pay any taxes when you sell your car to a private seller or a company like The Car Depot. Selling a car for more than you have invested in it is considered a capital gain. That means youll be taxed only on.

So if your used vehicle costs 20000. But if you buy privately from an. Answered by Edmund King AA President You dont have to pay any taxes when you sell a private car.

If the dealer offers you 25000 for it you now owe the dealer the 20000 balance for the new car. Depending on where you live when you buy a used car from a private party you most likely will be responsible for sales tax. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership.

Thus you have to pay capital. The party who buys the car from you pays the sales tax. When you sell your car you must declare the actual selling purchase price.

When you trade in a vehicle instead of paying tax on the full value of the new car you are taxed based on the difference in value between the trade-in and the new vehicle. In some places a use tax applies. You also want to trade in your old car.

In short yes you do have to pay sales tax on the purchase of a used car. The buyer is responsible for paying the sales tax. If your car is a collectible and has appreciated in.

And since Carmax is a dealer they dont pay the taxes when they buy the car from you. The short answer is maybe There are some circumstances where you must pay taxes on a car sale. Toyota of Naperville says these county taxes are far.

When Do You Pay Sales Tax On A Used Car. Thankfully the solution to this dilemma is pretty simple. When you sell a car for more than it is worth you do have to pay taxes.

Most car sales involve a vehicle that you bought new and are.

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

How To Buy A Car Out Of State Nextadvisor With Time

Why Should I Have To Pay Taxes On A Used Car The Globe And Mail

Does The Seller Of A Used Car In California Pay Taxes Quora

Should I Buy A Car From Carmax Rategenius

How To Buy A Used Car With Pictures Wikihow

Car Depreciation How Much Is Your Car Worth Ramsey

How Does The Electric Car Tax Credit Work U S News

California Used Car Sales Tax Fees 2020 Everquote

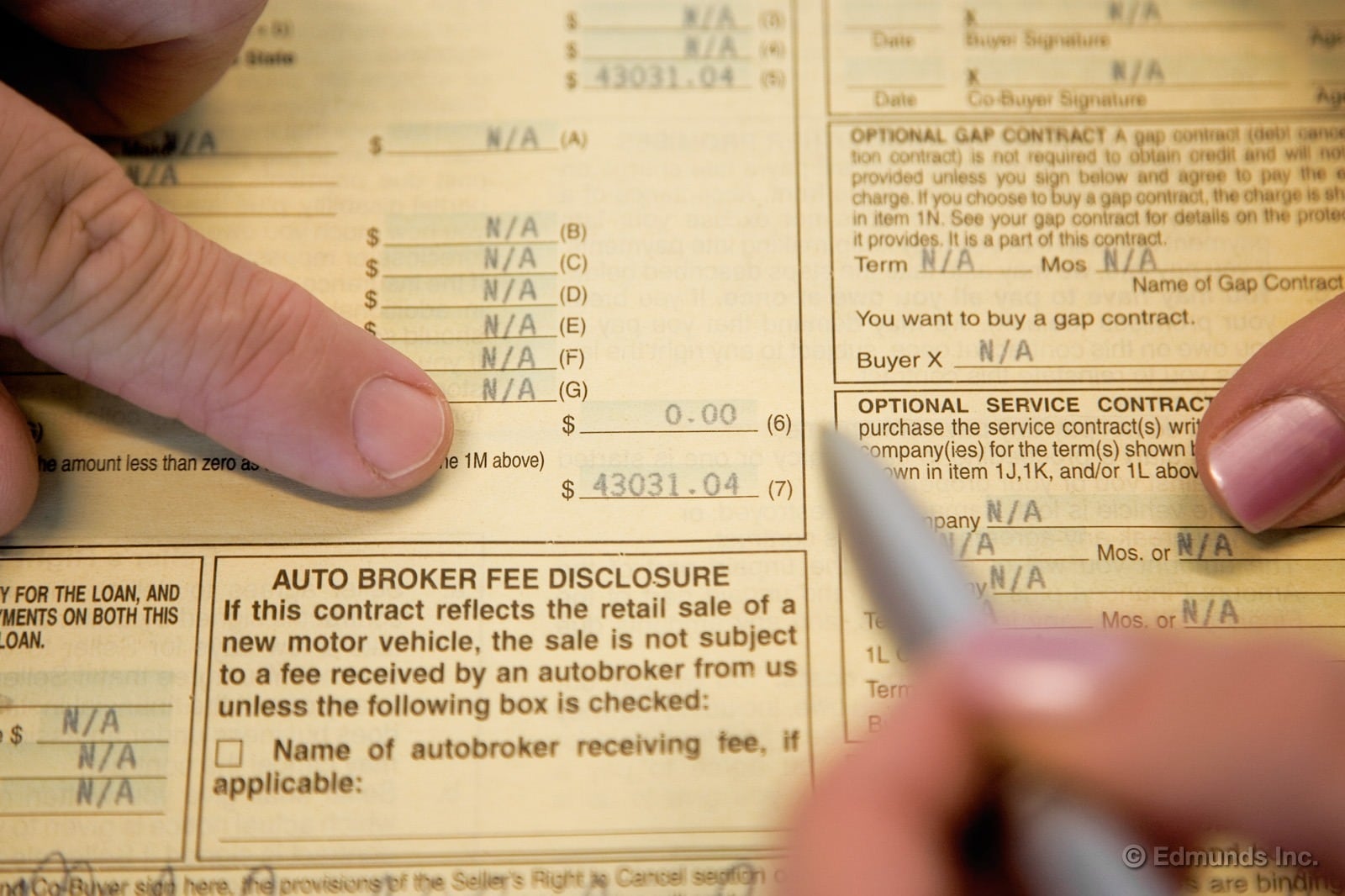

Get The Out The Door Price When Buying A Car Calculate Tax Title And Registration Edmunds

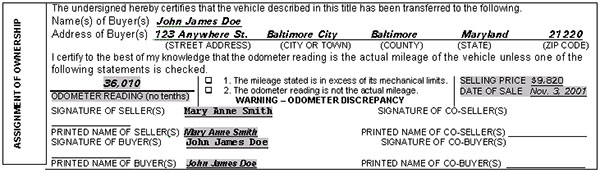

Buying A Vehicle In Maryland Pages

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

California Vehicle Tax Everything You Need To Know

Buying A Car Without A Title What You Should Know Experian

Virginia Sales Tax On Cars Everything You Need To Know

When I Sell My Car Do I Have To Pay Taxes Carvio

Registration For A Vehicle Purchased From A Dealer California Dmv